Виды компрессоров для работы – как правильно выбрать?

Автозапчасти

Эффективная защита от коррозии: всё, что нужно знать о антикоррозийной мастике

Статьи

Трубоизоляционные битумные материалы: свойства, применение и преимущества

Статьи

Сетка рабица: многоцелевой инструмент для обустройства и защиты территорий

Статьи

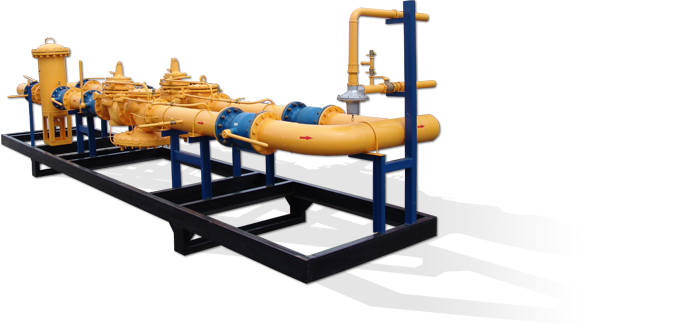

Основные принципы и функциональность блоков подготовки газа в промышленных процессах

Статьи

Функциональность автомобильного гидравлического подъемника: улучшение процесса обслуживания автомобилей

Статьи

Электролаборатория: Как правильно обратиться и получить качественную услугу

Статьи

Интерактивные столы: новая эра в визуальной коммуникации и организации рабочего пространства

Статьи